Every new project comes with its own set of potential risks waiting to be encountered. These risks can vary widely, from stakeholder misalignment to resource shortages to significant regulatory changes within the industry. Whether they lead to minor delays or major setbacks, it's crucial to identify and manage these risks effectively to improve the chances of success. This is especially important when considering that a staggering 65% of projects fail.

While it's impossible to completely eliminate risk, organizations can proactively anticipate and mitigate potential risks through a well-defined risk management process. By following a structured risk management framework, teams can defy the odds and prepare for success, enhancing their adaptability and responsiveness in the face of unforeseen challenges.

So, what does the risk management process involve? Simply put, it involves an ongoing cycle of identifying, addressing, and monitoring risks. Establishing and implementing a robust risk management process is like installing a fire alarm system, you hope it never needs to be activated, but you're willing to invest the time and effort upfront to protect against future uncertainties.

The benefits of identifying and monitoring potential project risks are manifold. They include:

- Enhanced resource planning efficiency by bringing previously unforeseen costs to light.

- Improved tracking of project expenditures and more accurate ROI estimations.

- Heightened awareness of legal obligations and compliance requirements.

- Enhanced prevention measures for physical injuries and health-related issues.

- Greater adaptability in the face of changes or obstacles, enabling a proactive response rather than reactive panic.

5 Steps to Master Risk and Resource Planning

Here are five essential steps to help you master risk management and resource planning in portfolio management:

1. Identify and Assess Risks Proactively

The first step in effective risk management is to identify potential risks before they escalate into issues. Conduct comprehensive risk assessments to identify and evaluate potential threats to your projects and portfolio. This includes assessing internal and external factors that could impact project delivery, such as market conditions, regulatory changes, resource constraints, and technological challenges. It also includes understanding the various components of the portfolio, such as projects, programs, and investments, and identifying risks associated with each.

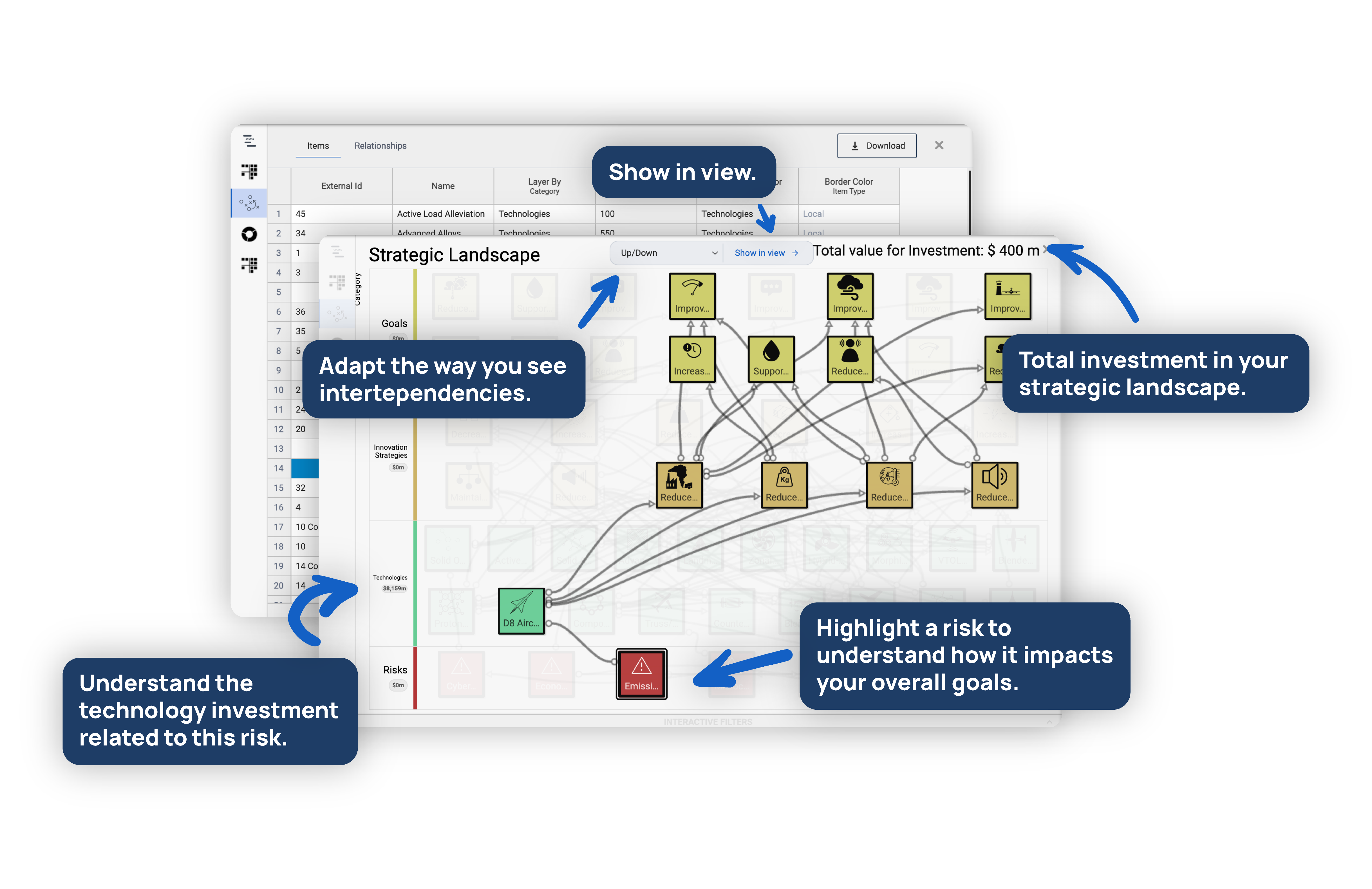

SharpCloud’s software connects every element of your portfolio, people, process, and technology, creating a connected map of your business. Understanding the unseen and unknown dependencies across siloed teams and portfolios allows you to uncover risks such as delivery delays, inefficiency and resource management discrepancies.

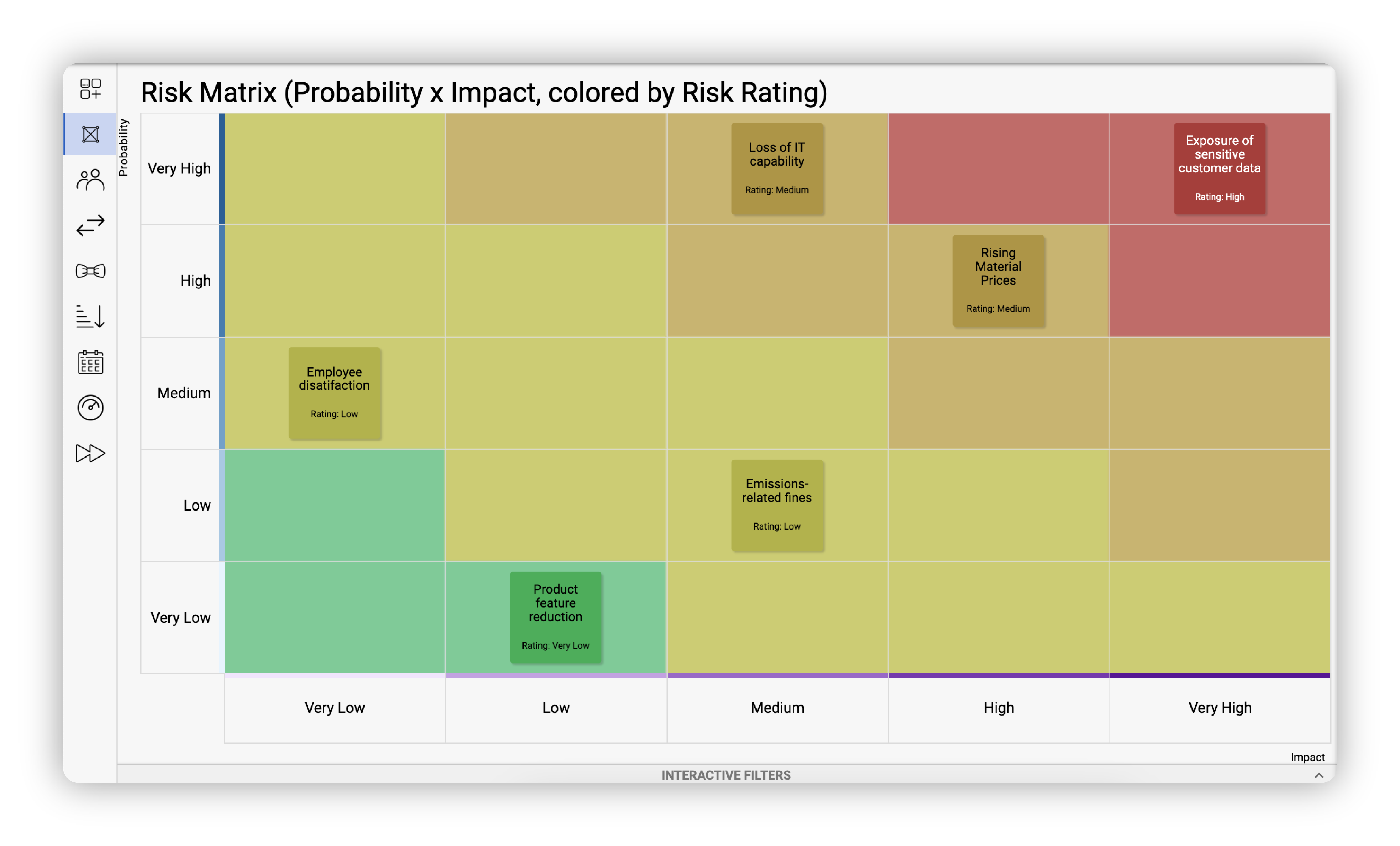

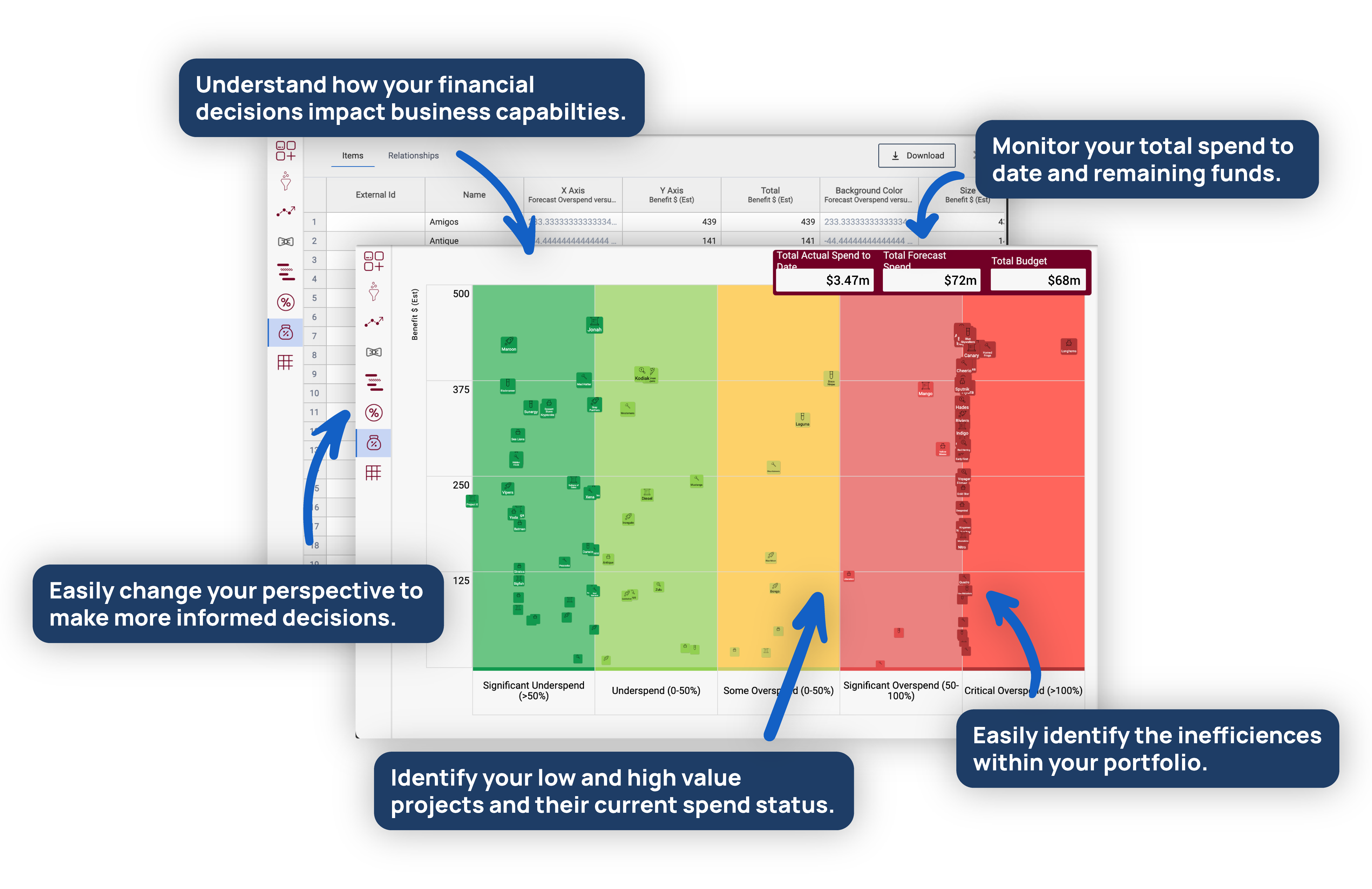

2. Prioritize Risks Based on Impact and Likelihood

Once you have identified potential risks, analyze and prioritize them based on their impact on project objectives, the likelihood of occurrence, and interdependencies. Focus on addressing high-impact risks that have the potential to derail project timelines, budget, or quality. Develop risk mitigation strategies and contingency plans to address these prioritized risks effectively.

3.Implement Robust Risk Mitigation Strategies

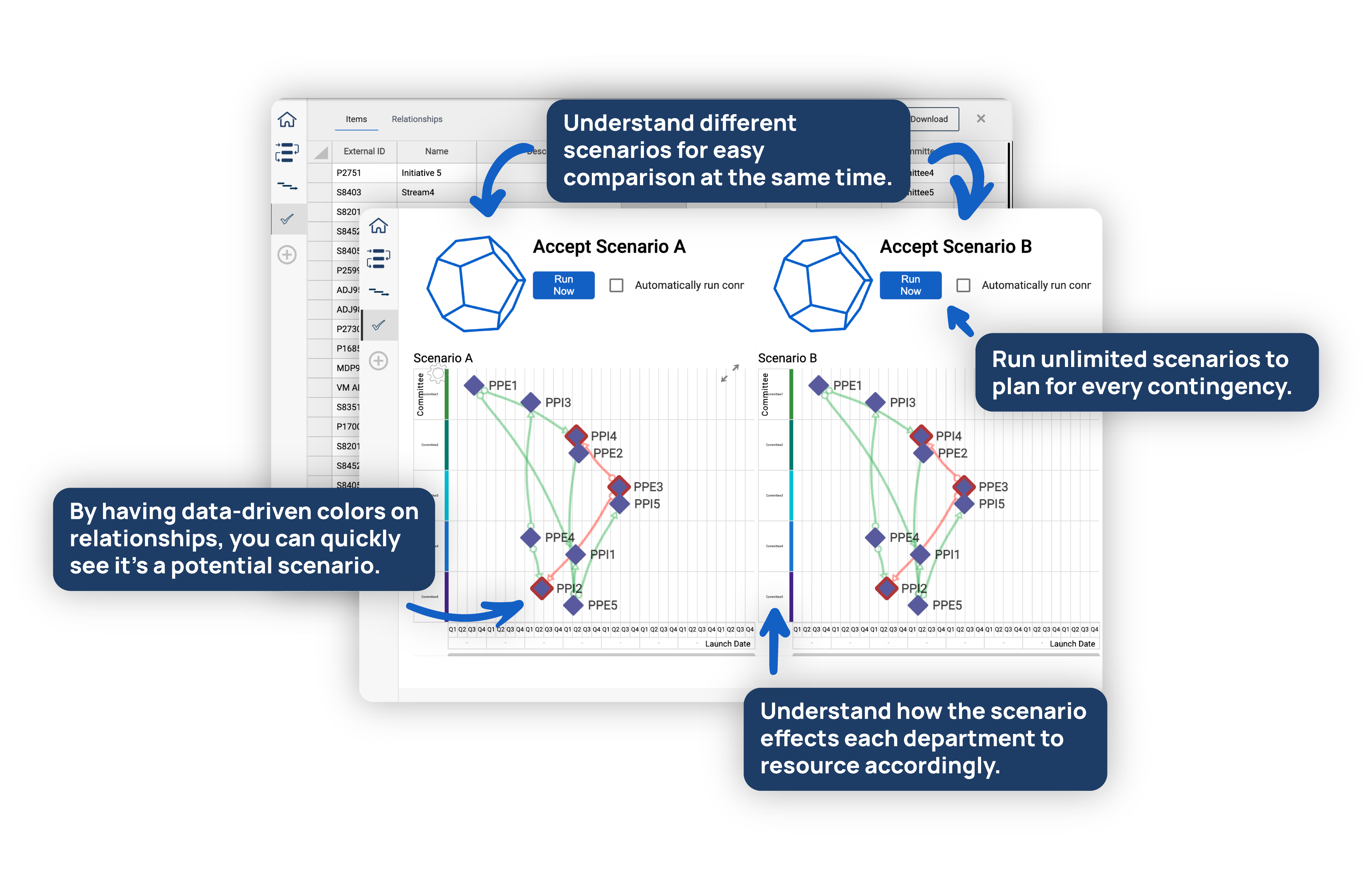

After prioritizing risks, implement robust risk mitigation strategies to minimize their impact on project outcomes. This may involve adopting proactive measures to prevent risks from materializing, such as implementing robust project governance frameworks, conducting regular risk reviews, and allocating resources strategically. Additionally, develop contingency plans to address risks that cannot be mitigated entirely, ensuring that you have a plan B in place to manage unforeseen challenges.

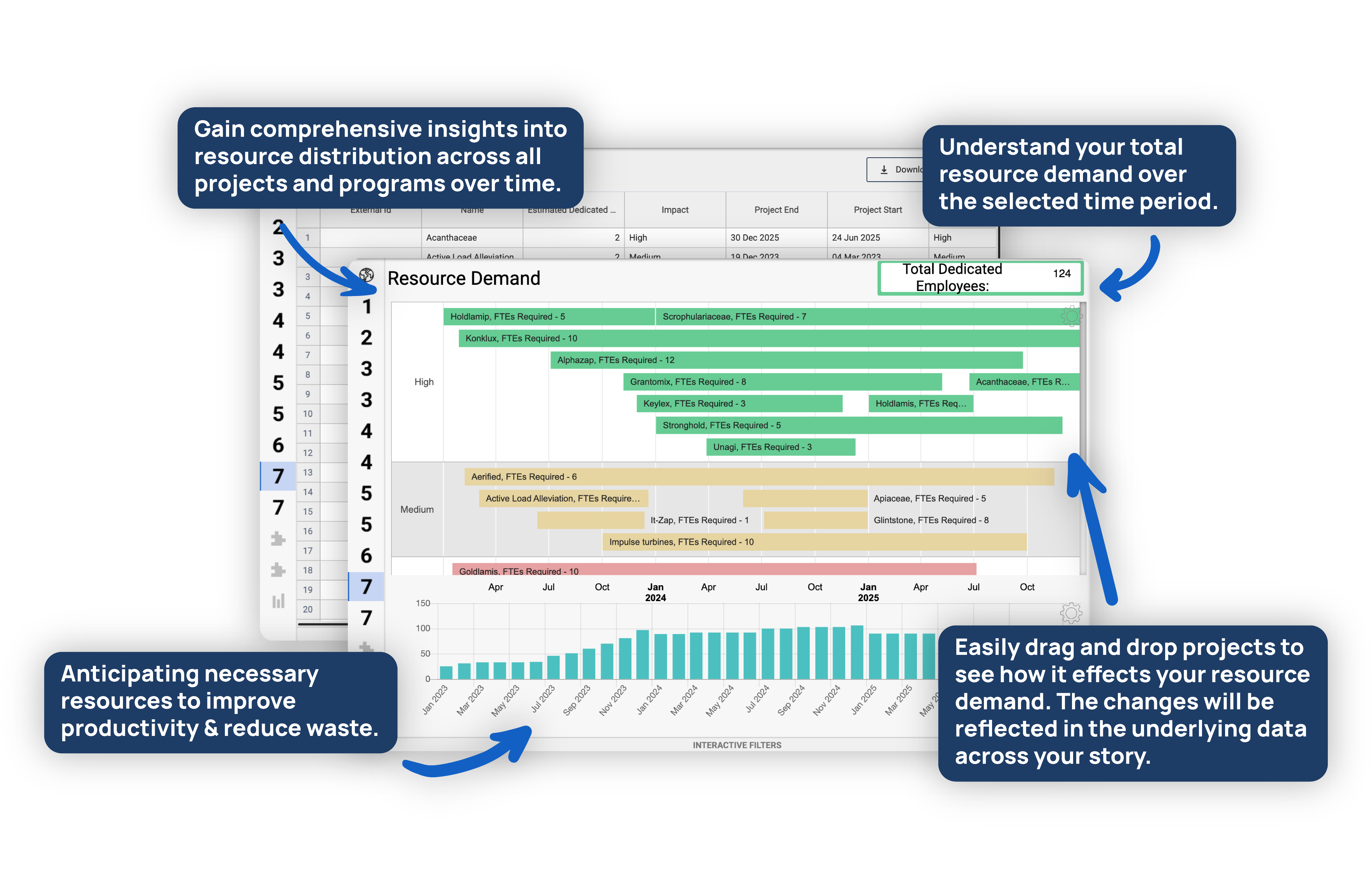

4. Optimize Resource Allocation and Capacity Planning

Effective resource planning is essential for maximizing productivity and minimizing project bottlenecks. Conduct thorough capacity planning to identify resource constraints and optimize resource allocation across projects based on their priority and strategic importance. This may involve leveraging resource management tools and techniques to balance workload, identify resource gaps, and align resource allocation with project requirements.

5. Monitor and Adapt to Changing Conditions

Portfolio management is an iterative process that requires continuous monitoring and adaptation to changing conditions. Implement robust monitoring and reporting mechanisms to track project progress, identify emerging risks, and assess resource utilization. Regularly review and update your risk management and resource planning strategies based on new insights and changing business dynamics, ensuring that you remain agile and responsive to evolving challenges and opportunities.

By following these five essential steps, you can enhance your organization's ability to master risk management and resource planning in portfolio management, thereby driving project success and achieving strategic objectives.

Benefits of Portfolio Risk Management

-

Protection of Investments: It helps protect investments by identifying potential risks and implementing strategies to mitigate them, reducing the likelihood of significant losses. By proactively managing risk levels, organizations can take on more risk while increasing overall portfolio value.

-

Enhanced Decision Making: By providing a comprehensive view of risks across the portfolio, it enables better decision-making regarding asset allocation, investment strategies, and risk tolerance.

-

Improved Performance: Effective risk management can lead to improved portfolio performance by optimizing risk-adjusted returns and minimizing unexpected setbacks.

-

Increased Confidence: Transparent risk management practices instill confidence in stakeholders, including investors, clients, and project teams. Investors gain confidence in their portfolio's ability to weather market fluctuations and uncertainties, fostering trust and satisfaction.

-

Regulatory Compliance: Adhering to risk management practices ensures compliance with regulatory requirements and industry standards, reducing the likelihood of penalties or legal issues.

-

Stakeholder Satisfaction: Stakeholders, including clients and shareholders, benefit from the transparency and accountability provided by robust risk management practices, leading to increased satisfaction and loyalty.

-

Opportunistic Positioning: By actively monitoring and managing risks, portfolio managers can capitalize on opportunities that arise during market volatility or shifts in economic conditions.

In the dynamic landscape of portfolio management, the effective management of risks and resources is crucial for ensuring project success and organizational growth, serving as critical tools for safeguarding investments, controlling costs, optimizing performance, and maintaining trust and compliance across your organization.