Project cost overruns are a persistent challenge across industries. Studies consistently show that 85% of large projects exceed their original budgets, with overruns averaging 28% and often reaching 100% or more. While numerous factors contribute to these failures, one factor consistently stands out: inadequate risk management. Projects frequently fail to identify, quantify, and mitigate risks before they escalate, consuming budgets and derailing timelines.

Traditional risk management processes relying on spreadsheets and periodic review meetings simply cannot keep pace with the complexity and speed of modern project portfolios. By the time risks surface in quarterly reviews, the damage is often done. Organizations need portfolio risk software that provides real-time visibility, enables proactive intervention, and transforms risk management from reactive crisis control into strategic cost management.

What is portfolio risk software and how does it help manage project uncertainty?

Portfolio risk software is a specialized class of management tools designed to identify, assess, and manage risks across multiple projects simultaneously. Unlike traditional project risk management software that focus on individual project risks, portfolio-level tools operates at the organizational level. It reveals how risks in one project cascade across others, creating systemic vulnerabilities that spreadsheet tracking alone cannot uncover.

Modern risk management software offers capabilities to track project risk that manual approaches cannot match:

-

Integrated risk visibility: Consolidated views show risk exposure across all projects, enabling portfolio-level risk assessment rather than isolated project-by-project evaluation.

-

Real-time monitoring: Continuous tracking of risk data and project performance indicators provides early warnings before minor issues turn into costly setbacks.

-

Scenario analysis: Modeling capabilities illustrate how different risk events impact budgets, timelines, and resource allocation across portfolios.

-

Collaborative risk assessment: Shared platforms allow team members, project managers, and risk analysts to contribute expertise and maintain up-to-date risk information.

-

Data-driven decision making: Advanced analytics transform uncertainty into quantified probabilities and financial impacts. This supports evidence-based allocation of resources and prioritization of mitigation actions.

By combining these capabilities, organizations can move from reactive, last-minute interventions to proactive cost management.

Why do project costs spiral without effective risk management tools?

To understand the importance of portfolio risk software, it helps to examine why project costs often escalate uncontrollably.

Invisible systemic risks

When risks are tracked only at the individual project level, organizations miss portfolio-level patterns. Multiple projects may share dependencies on the same specialized resources, creating bottlenecks that spreadsheet tracking cannot reveal. When these resources become unavailable, delays propagate across projects, amplifying costs.

Reactive rather than proactive management

Traditional risk management processes typically operate on monthly or quarterly cycles. Risk registers are updated periodically, discussed in scheduled meetings, and acted upon weeks after risk conditions change. This reactive approach means organizations often address problems after they have consumed budgets, rather than preventing them through early intervention.

Inadequate quantification

Spreadsheet-based risk tracking generally categorizes risks as "high," "medium," or "low," without rigorous quantification of financial impact or probability. This subjective method prevents meaningful forecasting and inhibits prioritization based on expected value. As a result, organizations may overinvest in low-impact risks while ignoring high-cost threats.

Poor cross-project visibility

Project managers focused on individual project success often fail to communicate risks with broader portfolio implications. Technical challenges in one project might have solutions developed in another, but siloed enterprise risk management prevents knowledge sharing. Duplicated problem-solving efforts can consume unnecessary budgets across multiple projects.

Lost mitigation opportunities

Without systematic identifying risks and quantifying their cost impact, organizations miss opportunities for cost-effective mitigation. For example, spending $50,000 on a mitigation strategy that prevents a $2 million overrun delivers an exceptional ROI - but only if the risk is recognized early enough to act.

What types of risks can project teams track and reduce using digital risk software?

Portfolio risk management software helps teams keep track of all the different risks that can affect project costs.

Operational risks

-

Resource availability: Risks that key personnel, specialized equipment, or materials won’t be available when needed, causing delays or premium costs.

-

Technical complexity: Risks that technical challenges require additional development cycles or expert consultation.

-

Process failures: Risks that execution processes break down, resulting in rework, quality issues, or regulatory compliance problems.

-

Dependency risks: Risks that projects relying on other projects’ deliverables experience delays when predecessor schedules slip.

Financial risks

-

Budget estimation errors: Risks that initial estimates prove overly optimistic, requiring budget supplements or scope reductions.

-

Exchange rate volatility: International projects face risks from currency fluctuations increasing costs beyond projections.

-

Funding availability: Risks that anticipated funding does not materialize as scheduled.

-

Cost escalation: Inflation, market conditions, or supply constraints drive costs above budgeted amounts.

Strategic risks

-

Market timing: Risks that project deliverables arrive too late to capture opportunities, reducing expected returns.

-

Competitive response: Risks that competitors’ actions reduce the strategic value of planned capabilities.

-

Technology obsolescence: Risks that technology choices become outdated during long project cycles.

-

Regulatory changes: Evolving regulatory requirements impose additional costs, technical adjustments, or delays.

External risks

-

Supplier performance: Risks that vendors, contractors, or partners fail to deliver, causing delays or premium costs.

-

Political and economic: Policy changes, economic downturns, or geopolitical events can affect projects.

-

Natural disasters: Weather events, pandemics, or other environmental disruptions impact execution.

-

Social and reputational: Stakeholder opposition or reputational risks can compromise project viability.

How does portfolio risk software improve cost forecasting and resource allocation?

Accurate cost management depends on risk-adjusted forecasting, not optimistic assumptions. Portfolio risk software turns guesswork into data-driven insights.

Probabilistic cost modeling

Rather than single-point estimates, modern risk management software generates probability distributions showing ranges of likely outcomes. Monte Carlo simulations model thousands of scenarios, combining potential risk events to provide realistic forecasts that account for uncertainty.

Organizations using probabilistic modeling often find traditional point estimates reflect best-case outcomes only 10–20% of the time. Risk-adjusted forecasts showing median and high-confidence outcomes provide more realistic planning targets, helping prevent chronic underestimation.

Dynamic resource optimization

Portfolio-level software highlights projects facing the highest-impact risks, enabling targeted resource allocation. Rather than spreading resources evenly, organizations prioritize mitigation where it produces the greatest cost savings. Risk heat maps showing project exposure and strategic value make these decisions intuitive for leadership.

Adaptive budget reserves

Traditional contingency reserves are often arbitrary, typically 10–20% of base estimates. Portfolio risk software calculates reserves based on quantified risk probability and impact. Well-understood projects require smaller reserves, while complex or novel projects justify larger contingencies, ensuring resources are sufficient without waste.

Features of effective portfolio risk software

Large organizations require risk management tools with capabilities beyond basic project management software:

-

Integrated multi-project visibility: Consolidated views across all projects reveal portfolio-wide exposure and cross-project dependencies. Teams need the ability to drill down from portfolio overviews to individual project details without switching systems.

-

Real-time risk data integration: Rather than manual risk register updates, automatic updates from project management, financial, and operational systems ensure current risk insights, rather than outdated snapshots.

-

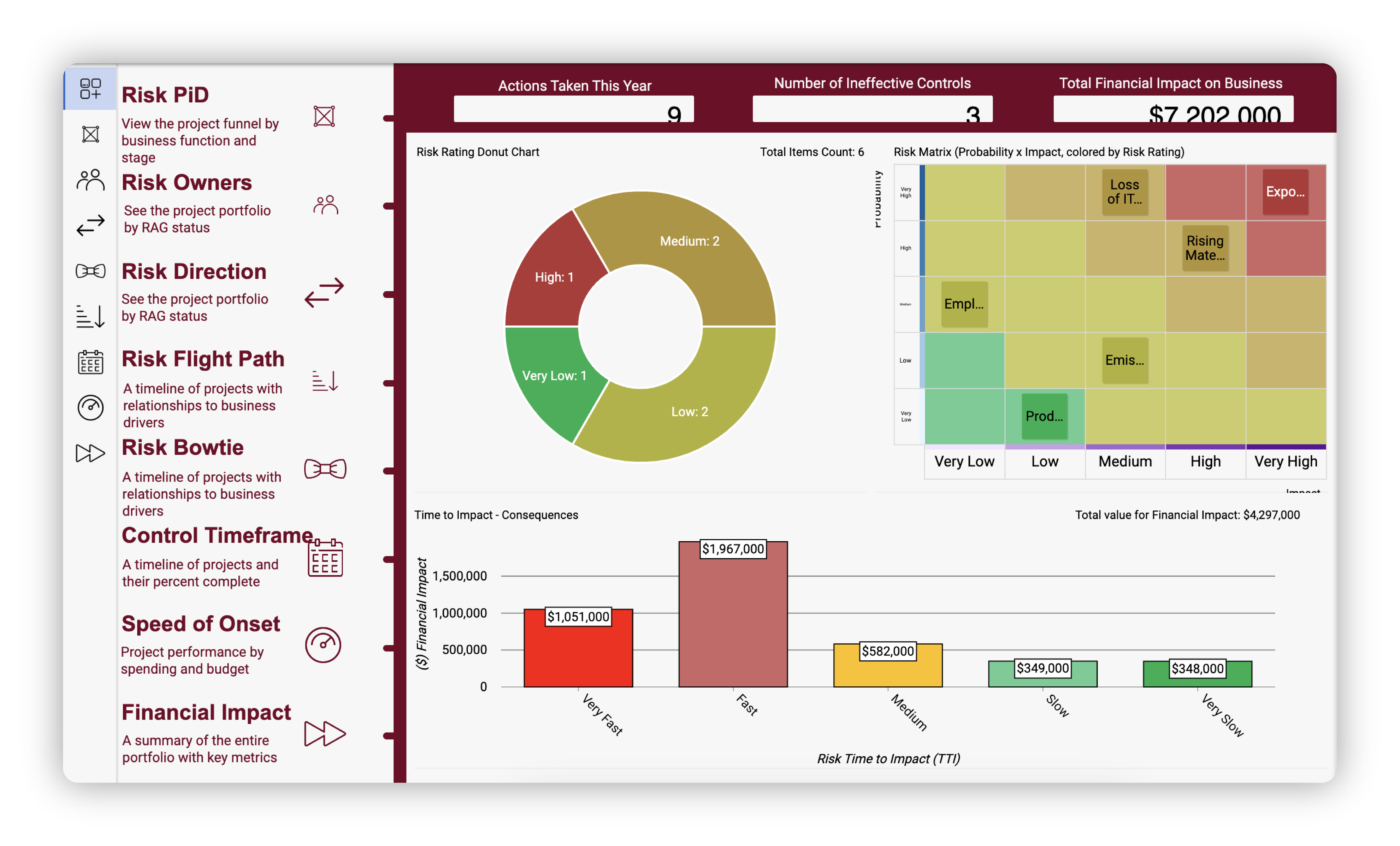

Visual risks based analytics: Holistic view dashboards make complex risk data immediately comprehensible with heat maps, trend charts, and scenario comparisons, to simplify decision-making.

-

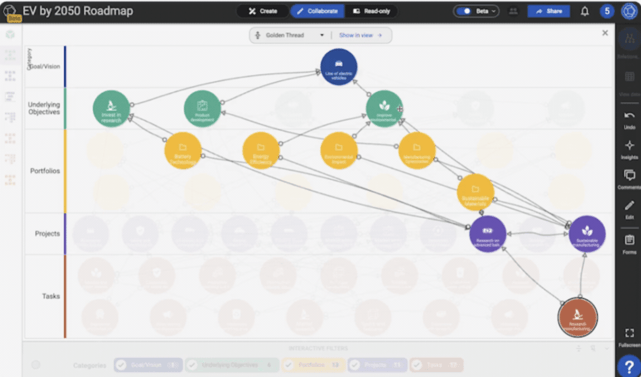

Collaborative risk assessment: Role-based access allows multiple team members to contribute insights securely and review assessments.

.png?width=960&height=541&name=Website_Blog-SRoadmapTools-Collaborate%20(optimized).png)

-

Scenario modeling: Explore “what-if” scenarios for different risks and mitigation strategies before committing resources.

.webp?width=1344&height=1053&name=5_Scenario%20Modelling%20(optimized).webp)

-

Seamlessly integrates with existing tools: Enhances workflows without forcing system replacements.

-

Compliance and audit support: Comprehensive risk registers, audit trails, and regulatory reporting capabilities.

-

Advanced analytics and reporting: Shows risk trends, mitigation effectiveness, and portfolio performance against risk-adjusted forecasts.

How teams can visualize risk across projects

Visualization turns raw risk data into actionable intelligence:

-

Risk heat maps and dashboards: Color-coded maps indicate projects with high probability × impact risks.

.png?width=1241&height=750&name=Website_ERiskManagement-02%20(optimized).png)

-

Network dependency visualization: Reveals how delays propagate through interconnected projects.

-

Trend analysis and early warnings: Time-series visuals identify emerging risks before they escalate.

-

Portfolio risk distribution: Shows exposure across operational, financial, strategic, and external risk categories.

ROI of portfolio risk management software

Organizations report measurable benefits from modern portfolio risk software:

-

Direct cost avoidance: 15–30% reductions in cost overruns. For a $100 million portfolio, that’s $15–30 million in savings.

-

Improved project success rates: 30–40% higher on-time, on-budget completion rates.

-

Faster decision-making: Leadership can act in minutes instead of weeks.

-

Enhanced resource utilization: Resources go where they prevent the most cost.

-

Better stakeholder confidence: Transparent risk insights improve funding, contracts, and support.

How portfolio risk software prevents costly overruns

Effective software can support and proactively manage risk:

-

Identifying risks early to mitigate risks: Detect threats early in the project lifecycle.

-

Predictive analytics: Machine learning identifies patterns that precede overruns.

-

Proactive mitigation planning: Implement strategies for high-impact risks before they occur.

-

Cross-project learning: Share lessons across portfolios.

-

Continuous monitoring and adaptive response: Real-time tracking triggers reassessment as conditions evolve.

Why choose SharpCloud for portfolio-level risk visibility?

SharpCloud’s visual collaboration platform provides a holistic view of your portfolio and addresses portfolio risk challenges:

-

Integrated multi-source risk intelligence: Unifies risk data from multiple systems.

-

Interactive visual risk analytics: Heat maps, dependency networks, and trends reveal actionable insights.

-

Scenario modeling without rebuilding models: Test “what-if” scenarios instantly.

-

Shared risk intelligence platform: Single source of truth for teams and leadership.

-

Accelerated governance and reporting: Interactive dashboards support board reporting and procurement decisions.

-

Layered cost, schedule, and dependency analysis: Reveals how risks affect timelines, budgets, and interdependencies.

-

Scalable portfolio risk patterns: Identifies systemic risks affecting multiple projects.

Conclusion: From cost overruns to cost control

Project cost overruns are symptoms of inadequate risk management. Organizations relying on spreadsheets and periodic reviews risk continuing the 85% overrun trend. Portfolio risk software transforms risk management from reactive damage control into strategic cost management, delivering 15–30% reductions in cost overruns, 30–40% improvements in project success, and faster decision-making.

For organizations managing large portfolios, these improvements translate to millions in annual savings. The question isn’t whether you can afford portfolio risk software - it’s whether you can afford not to use it.